BROWSE BY TOPICS

- CGST Act 2017,

- FSSAI Food License,

- Goods and Services Tax (GST),

- GST Rates & HSN Code,

- IEC Import export code,

- Income tax return,

- Investments and Savings,

- LLP registration,

- one person company,

- Private Limited company,

- RUN (Reserve Unique Name),

- SSI/MSME Registration,

- Startups,

- Tax Saving Tips,

- Trademark & Copyright,

- Uncategorized

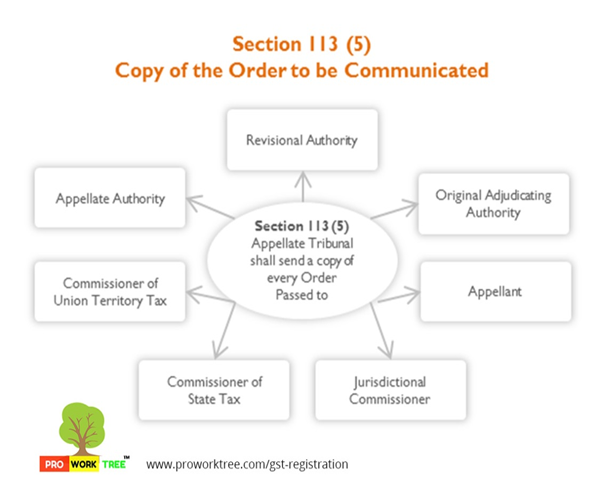

Orders of Appellate Tribunal Under CGST Act

Orders of Appellate Tribunal Under CGST Act

Section 113 (5) Copy of the Order to be Communicated

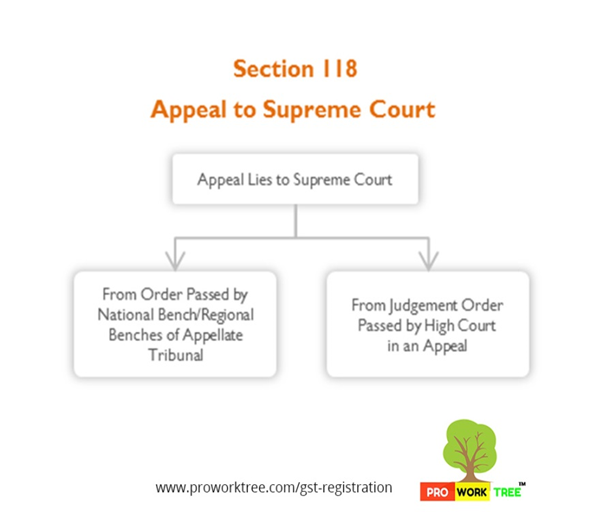

Appeal to Supreme Court Under CGST Act

Appeal to Supreme Court Under CGST Act

Section 118 Appeal to Supreme Court

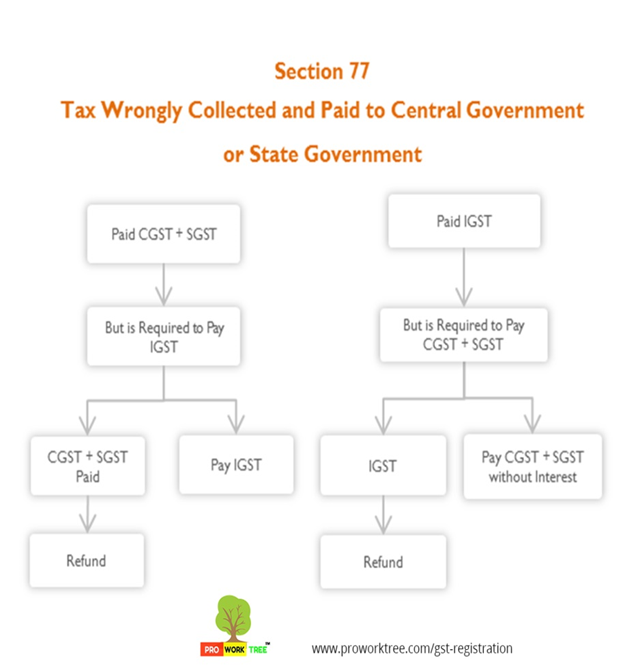

Tax wrongfully collected and paid to Central Government or State Government Under CGST Act

Tax wrongfully collected and paid to Central Government or State Government Under CGST Act

Section 77 Tax Wrongly Collected and Paid to Central Government or State Government

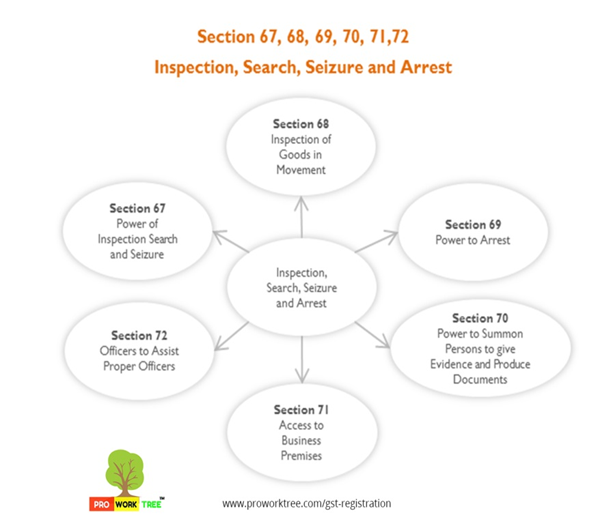

Power to arrest Under CGST Act

Power to arrest Under CGST Act

Section - 69 Inspection, Search, Seizure and Arrest

Appeal to High Court Under CGST Act

Appeal to High Court Under CGST Act

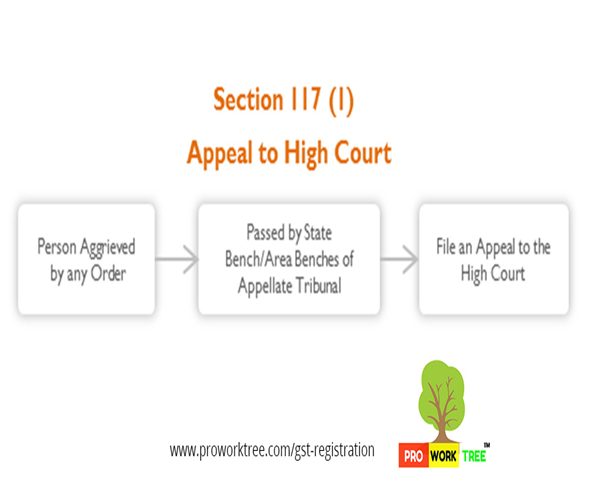

Section 117 (1) Appeal to High Court

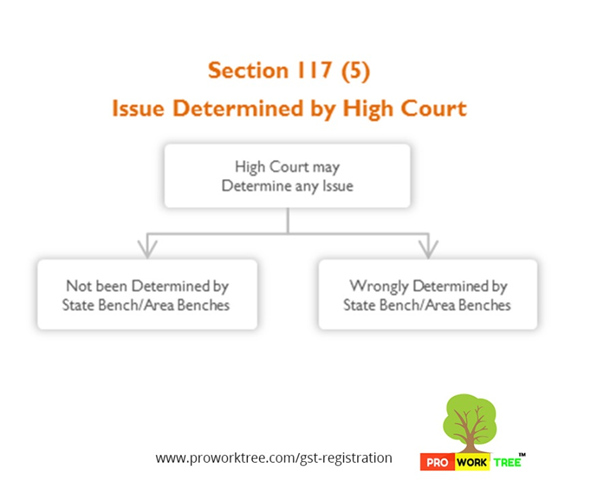

Section 117 (5) Issue Determined by High Court

Corporate Entity Registration

Corporate Entity Registration