BROWSE BY TOPICS

- CGST Act 2017,

- FSSAI Food License,

- Goods and Services Tax (GST),

- GST Rates & HSN Code,

- IEC Import export code,

- Income tax return,

- Investments and Savings,

- LLP registration,

- one person company,

- Private Limited company,

- RUN (Reserve Unique Name),

- SSI/MSME Registration,

- Startups,

- Tax Saving Tips,

- Trademark & Copyright,

- Uncategorized

Apportionment of credit and blocked credits Under CGST Act

Apportionment of credit and blocked credits Under CGST Act

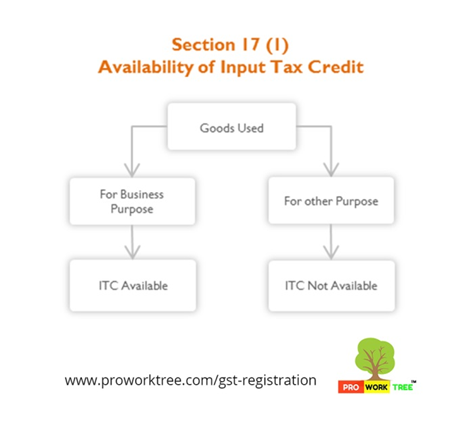

Section 17 (1) Availability of Input Tax Credit

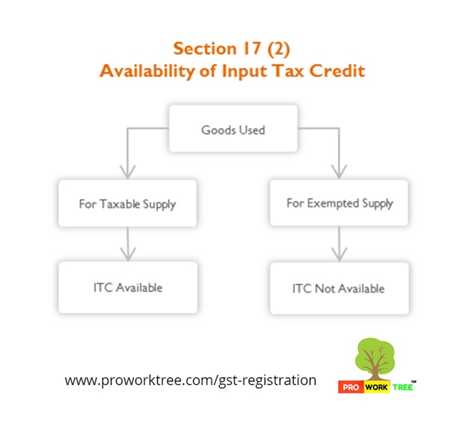

Section 17 (2) Availability of Input Tax Credit

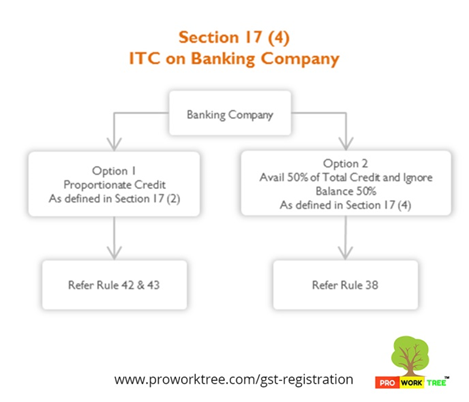

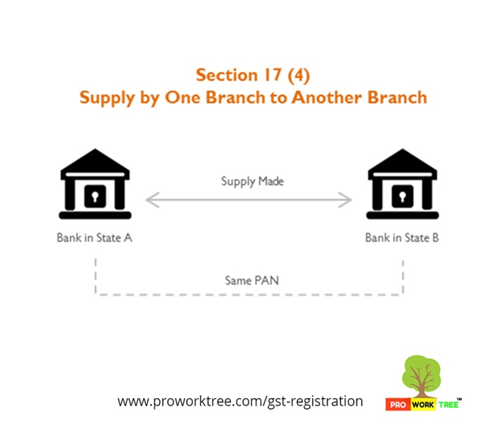

Section 17 (4) ITC on Banking Company

Section 17 (4) Supply by One Branch to Another Branch

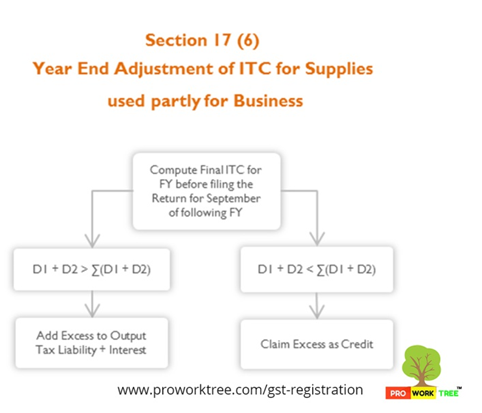

Section 17 (6) Year End Adjustment of ITC for Supplies used partly for Business

Time of supply of services Under CGST Act

Time of supply of services Under CGST Act

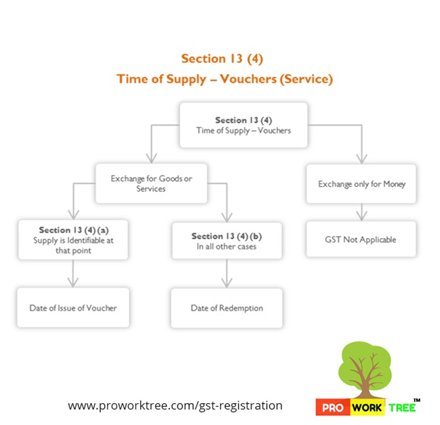

Section 13 Time of Supply of Services

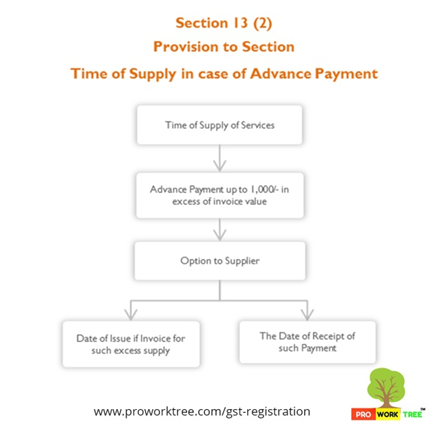

Section 13 (2) Provision to Section Time of Supply in case of Advance Payment

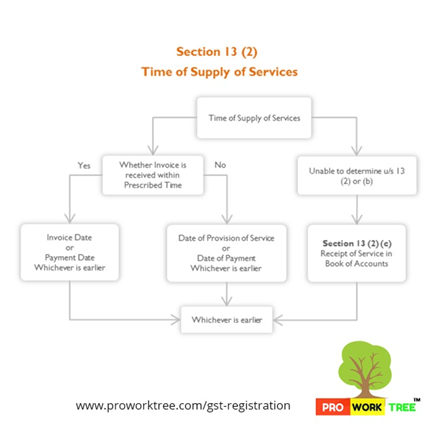

Section 13 (2) Time of Supply of Services

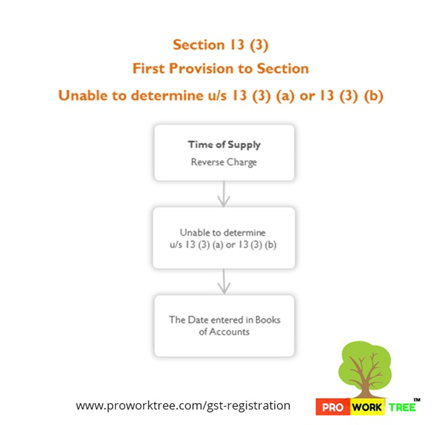

Section 13 (3) First Provision to Section Unable to determine under Section 13 (3) (a) or 13 (3) (b)

Section 13 (3) Time of Supply In case of Reverse Charge

Time of supply of goods Under CGST Act

Time of supply of goods Under CGST Act

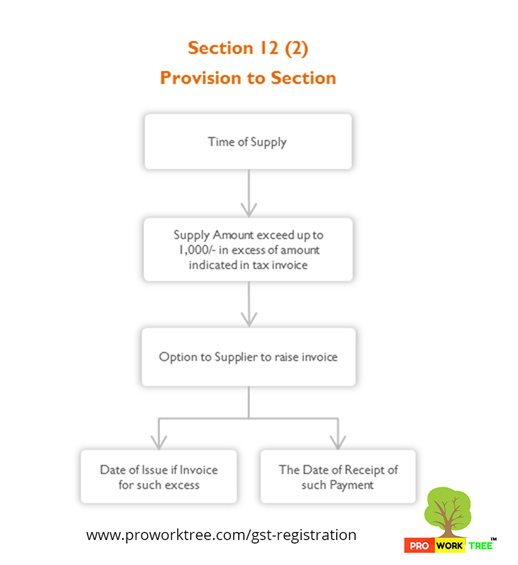

Section 12 (2) Provision to Section

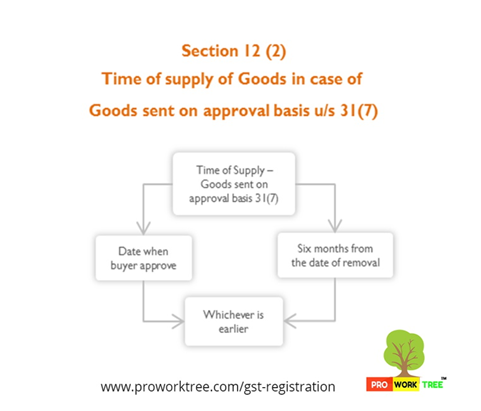

Section 12 (2) Time of supply of Goods in case of Goods sent on approval basis under Section 31(7)

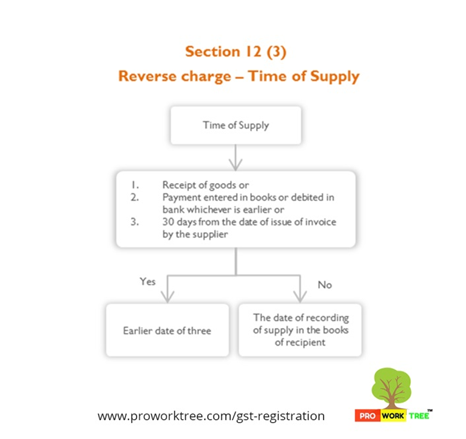

Section 12 (3) Reverse charge Time of Supply

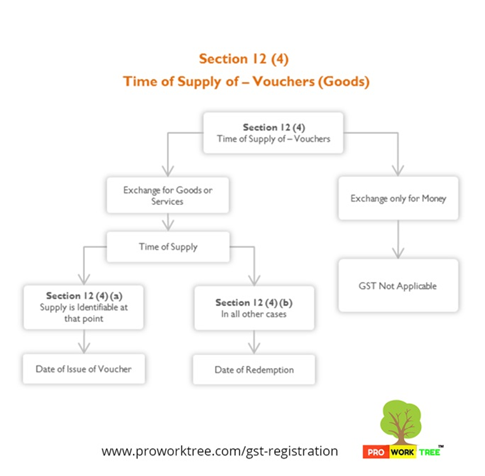

Section 12 (4) Time of Supply of Vouchers (Goods)

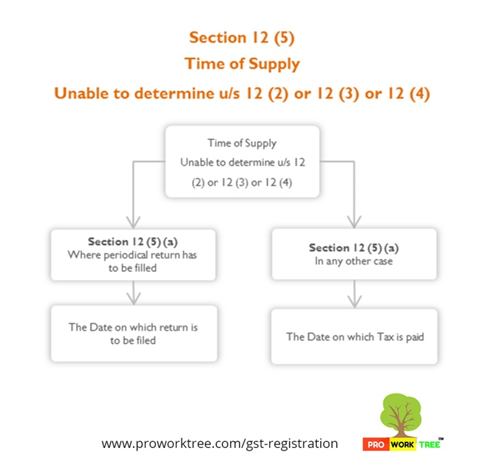

Section 12 (5) Time of Supply Unable to determine under Section 12 (2) or 12 (3) or 12 (4)

Section …

Eligibility and conditions for taking input tax credit Under CGST Act

Eligibility and conditions for taking input tax credit Under CGST Act

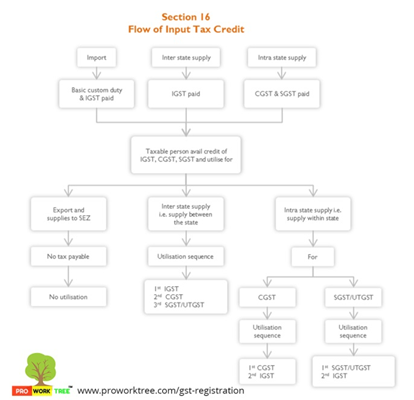

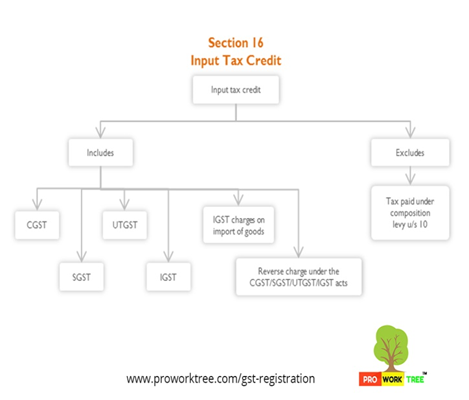

Section 16 Flow of Input Tax Credit

Section 16 Input Tax Credit

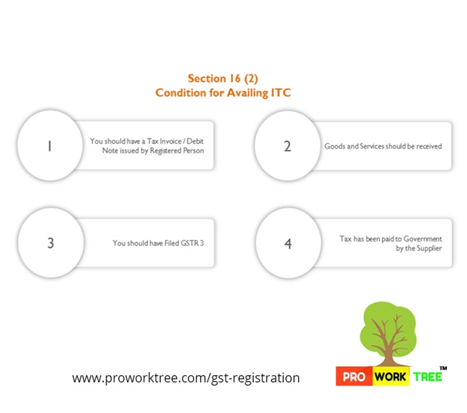

Section 16 (2) Condition for Availing ITC

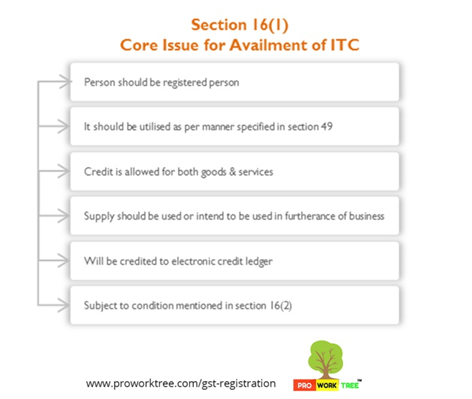

Section 16-1 Core Issue for Availment of ITC

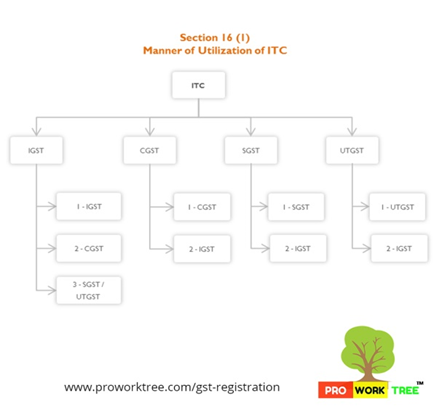

Section 16 (1) Manner of Utilization of ITC

Section 16 (2) Condition for Availing ITC

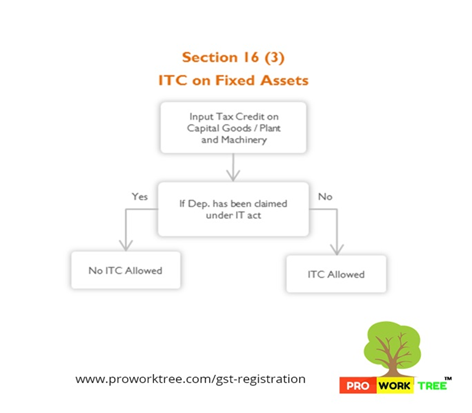

Section 16 (3) ITC on Fixed Assets

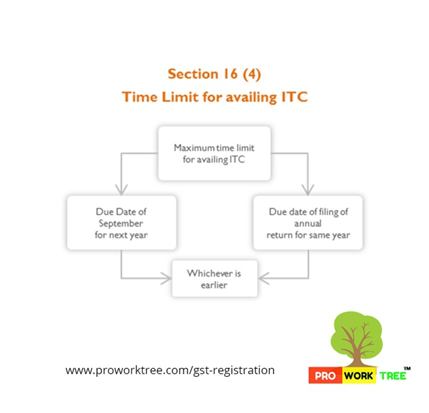

Section 16 (4) Time Limit for availing ITC

Availability of credit in special circumstances

Availability of credit in special circumstances

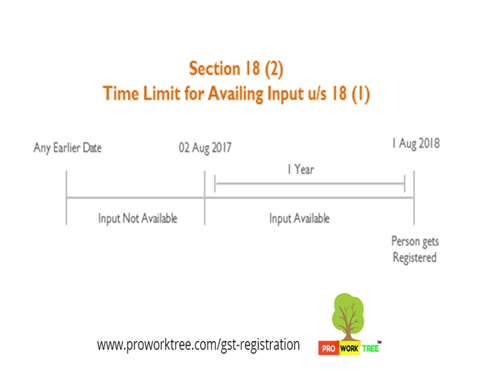

Section-18 (2) Time Limit for Availing Input under Section 18 (1)

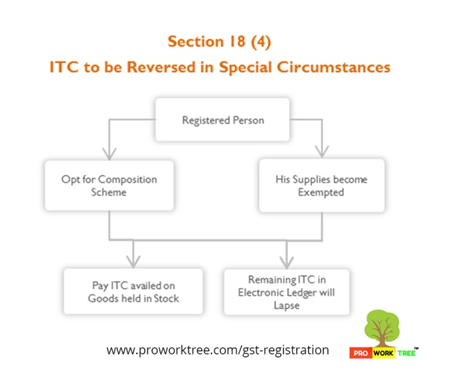

Section 18 (4) ITC to be Reversed in Special Circumstances

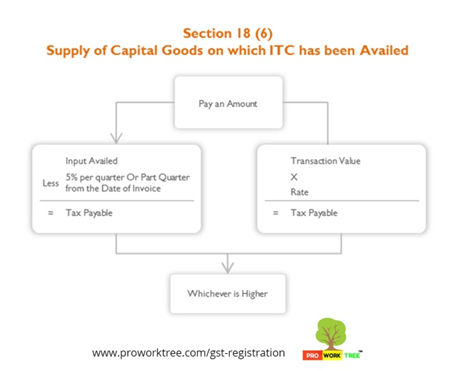

Section 18 (6) Supply of Capital Goods on which ITC has been Availed

Corporate Entity Registration

Corporate Entity Registration