BROWSE BY TOPICS

- CGST Act 2017,

- FSSAI Food License,

- Goods and Services Tax (GST),

- GST Rates & HSN Code,

- IEC Import export code,

- Income tax return,

- Investments and Savings,

- LLP registration,

- one person company,

- Private Limited company,

- RUN (Reserve Unique Name),

- SSI/MSME Registration,

- Startups,

- Tax Saving Tips,

- Trademark & Copyright,

- Uncategorized

Taking input tax credit in respect of inputs and capital goods sent for job work Under CGST Act

Taking input tax credit in respect of inputs and capital goods sent for job work Under CGST Act

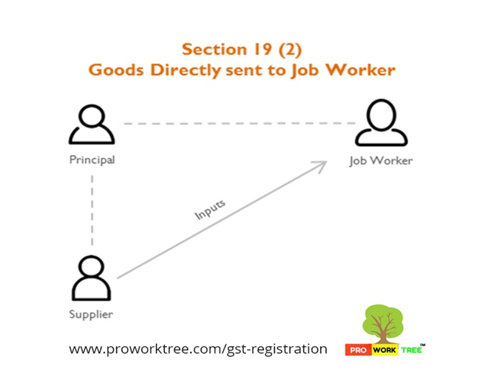

Section 19 (2) Goods Directly sent to Job Worker

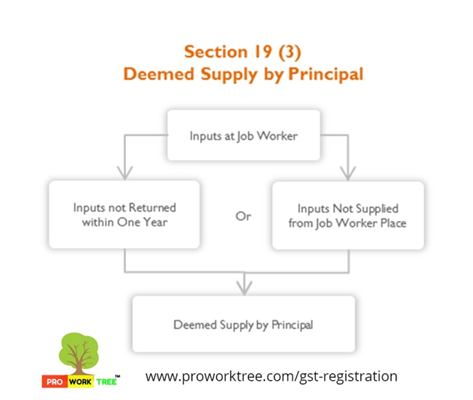

Section 19 (3) Deemed Supply by Principal

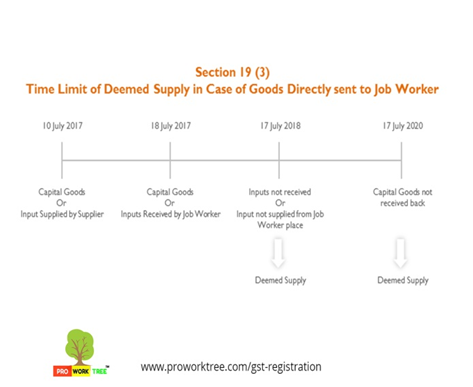

Section 19 (3) Time Limit of Deemed Supply in Case of Goods Directly sent to Job Worker

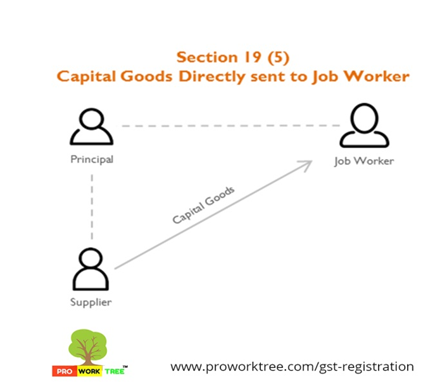

Section 19 (5) Capital Goods Directly sent to Job Worker

Section 19 (6) Deemed Supply of Capital Goods sent …

Time of supply of goods Under CGST Act

Time of supply of goods Under CGST Act

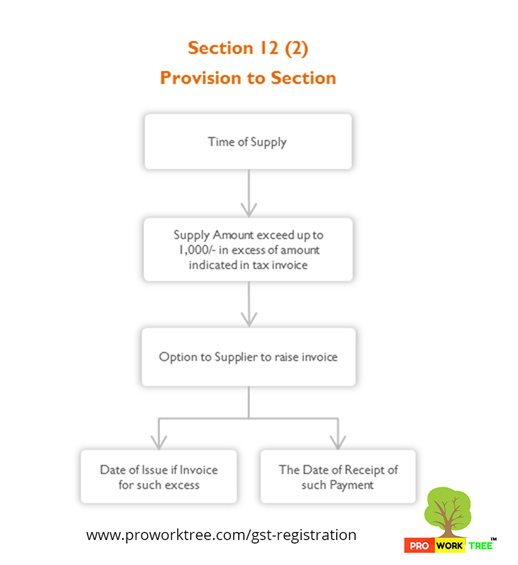

Section 12 (2) Provision to Section

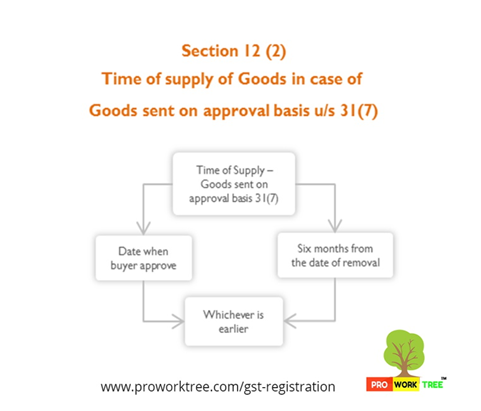

Section 12 (2) Time of supply of Goods in case of Goods sent on approval basis under Section 31(7)

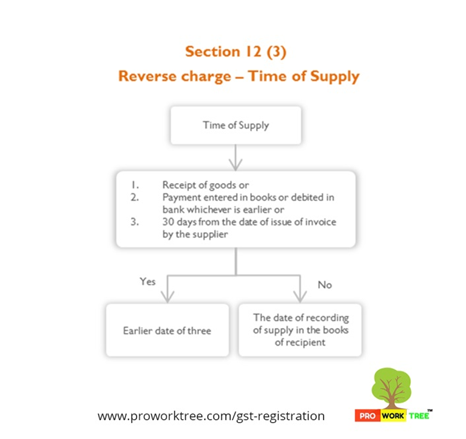

Section 12 (3) Reverse charge Time of Supply

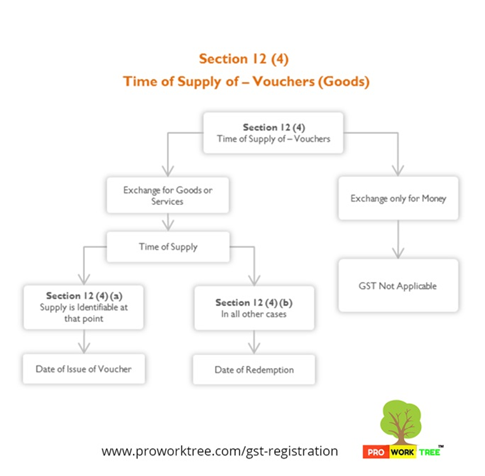

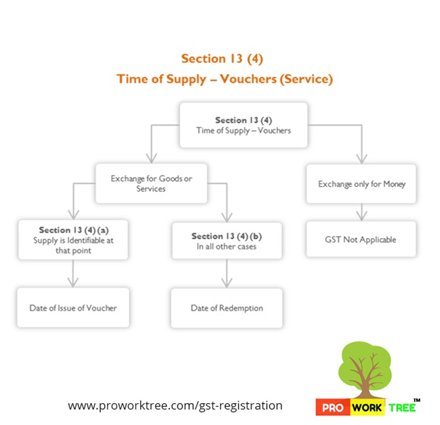

Section 12 (4) Time of Supply of Vouchers (Goods)

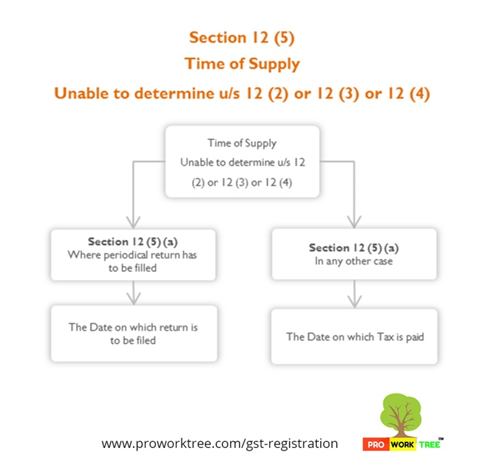

Section 12 (5) Time of Supply Unable to determine under Section 12 (2) or 12 (3) or 12 (4)

Section …

Apportionment of credit and blocked credits Under CGST Act

Apportionment of credit and blocked credits Under CGST Act

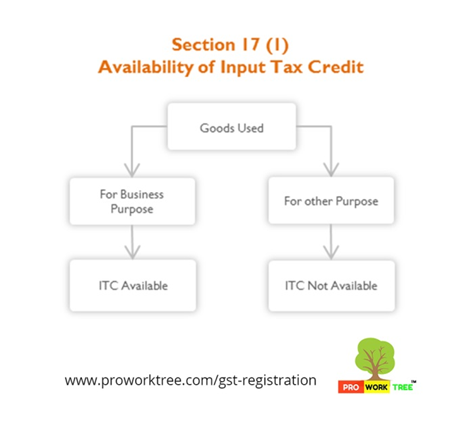

Section 17 (1) Availability of Input Tax Credit

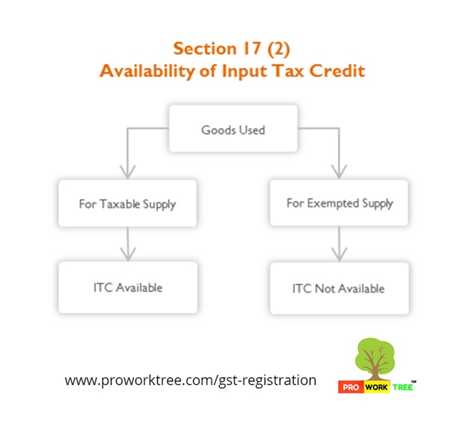

Section 17 (2) Availability of Input Tax Credit

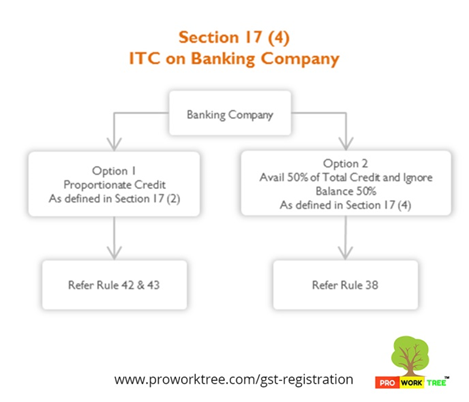

Section 17 (4) ITC on Banking Company

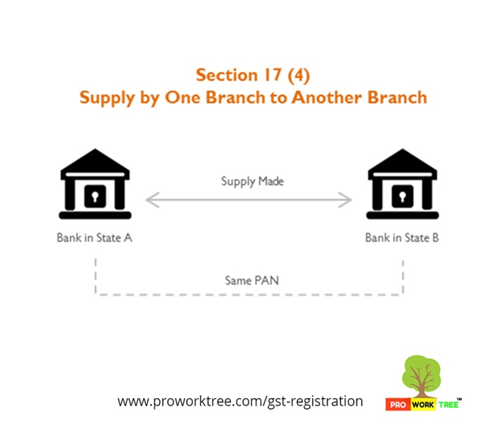

Section 17 (4) Supply by One Branch to Another Branch

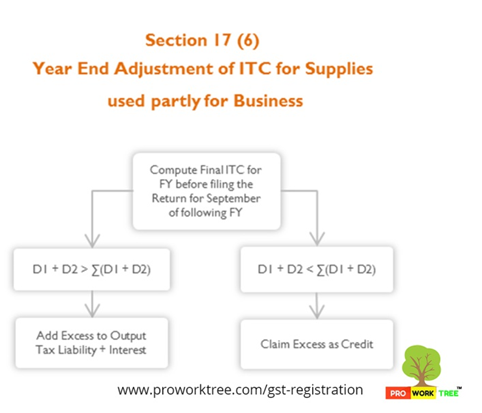

Section 17 (6) Year End Adjustment of ITC for Supplies used partly for Business

Time of supply of services Under CGST Act

Time of supply of services Under CGST Act

Section 13 Time of Supply of Services

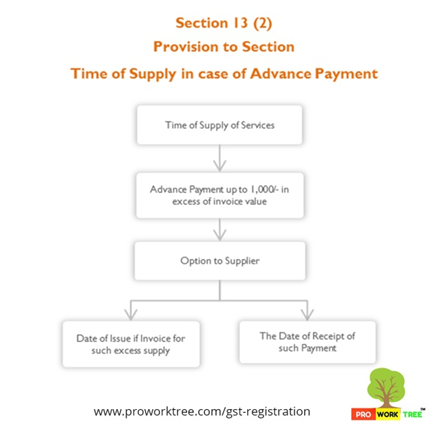

Section 13 (2) Provision to Section Time of Supply in case of Advance Payment

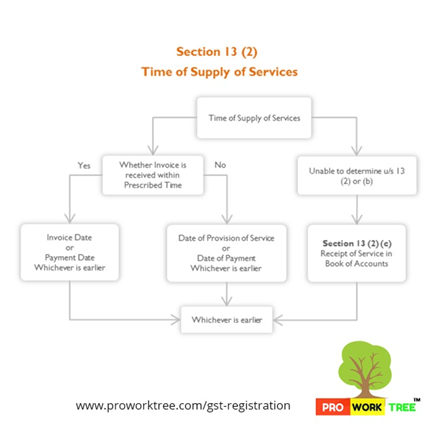

Section 13 (2) Time of Supply of Services

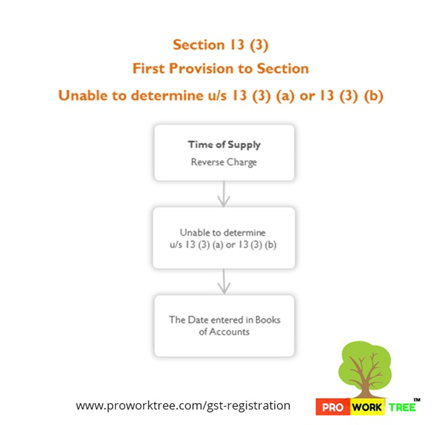

Section 13 (3) First Provision to Section Unable to determine under Section 13 (3) (a) or 13 (3) (b)

Section 13 (3) Time of Supply In case of Reverse Charge

Compliance with respect to Registration

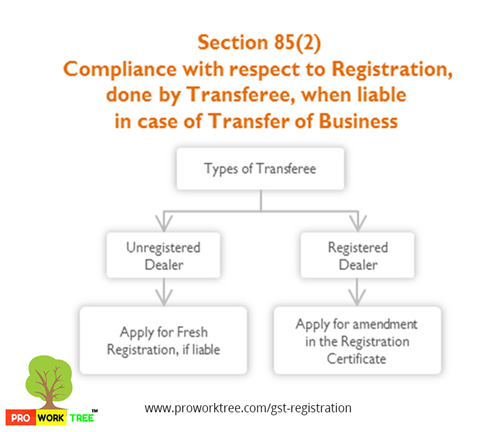

85(2)Compliance with respect to Registration, done by Transferee, when liable in case of Transfer of Business

Corporate Entity Registration

Corporate Entity Registration