Payment of tax, interest, penalty and other amounts Under CGST Act

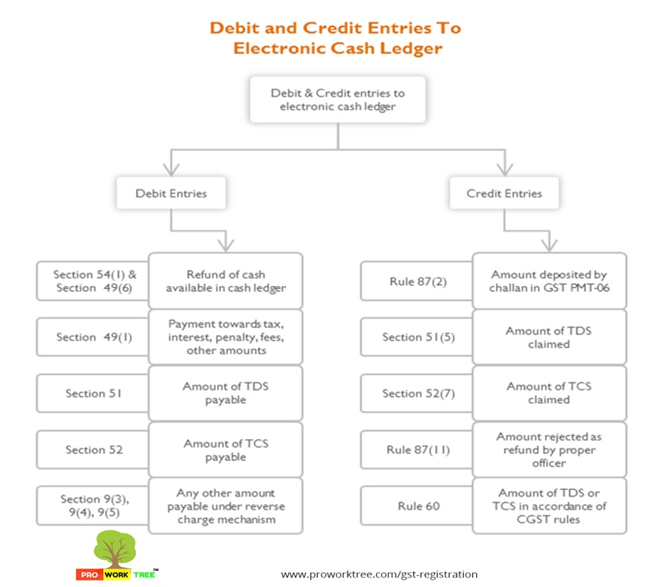

Section 49 Debit and Credit Entries To Electronic Cash Ledger

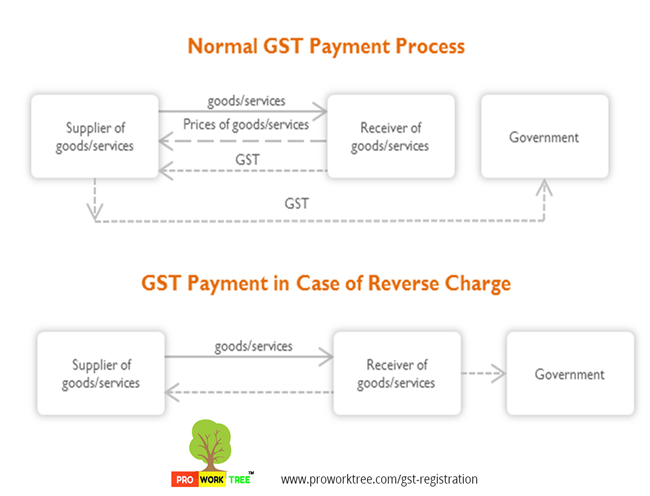

Section 49 Payment of GST in normal case and in case of Reverse Charge Mechanism

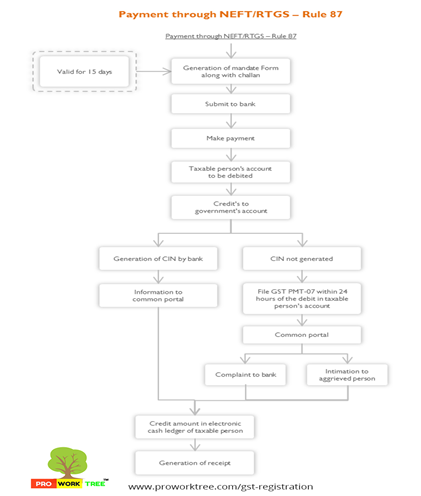

Section 49 Payment through NEFT-RTGS - Rule 87

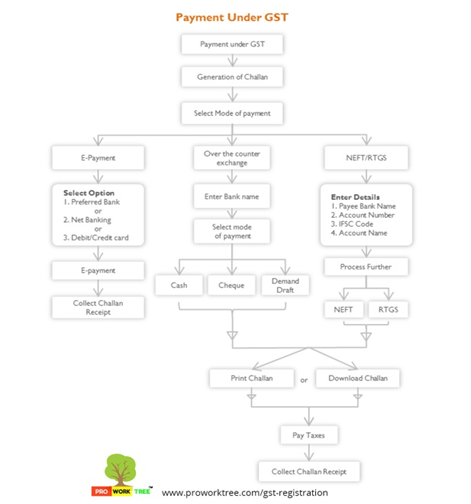

Section 49 Payment Under GST

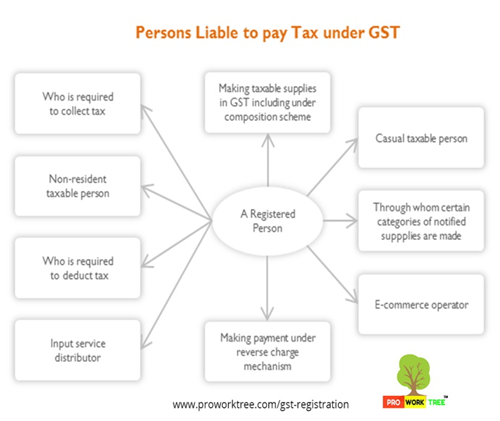

Section 49 Persons Liable to pay Tax under GST

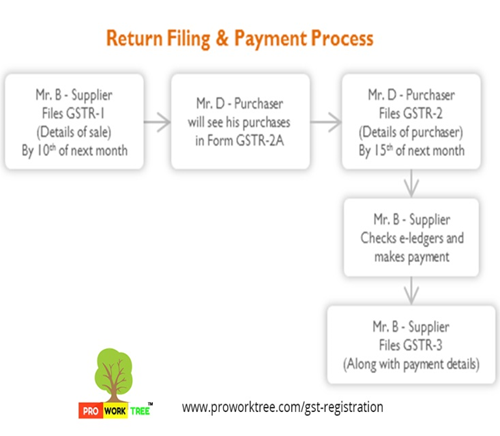

Section 49 Return Filing _ Payment Process

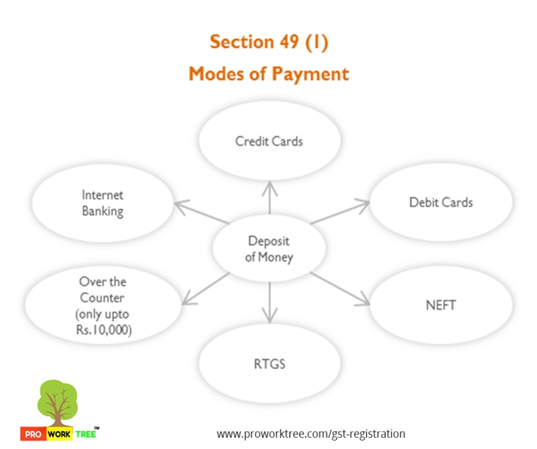

Section 49 (1) Modes of Payment

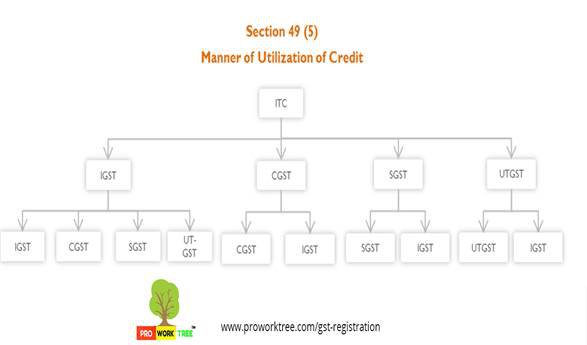

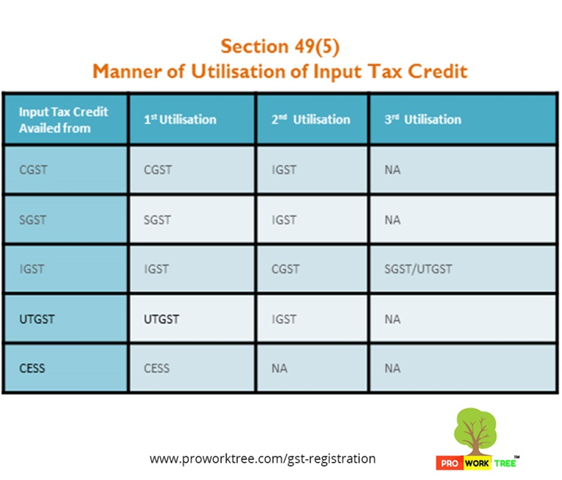

Section 49 (5) Manner of Utilization of Credit

Section 49-5 Manner of Utilisation of Input Tax Credit

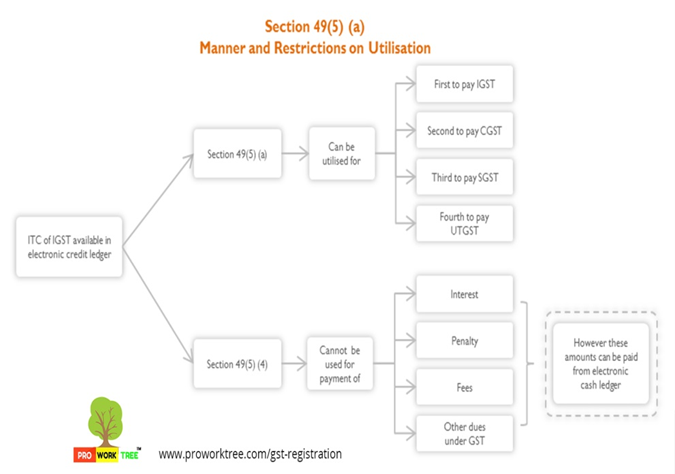

Section 49 - 5 - a Manner and Registration on Utilisation

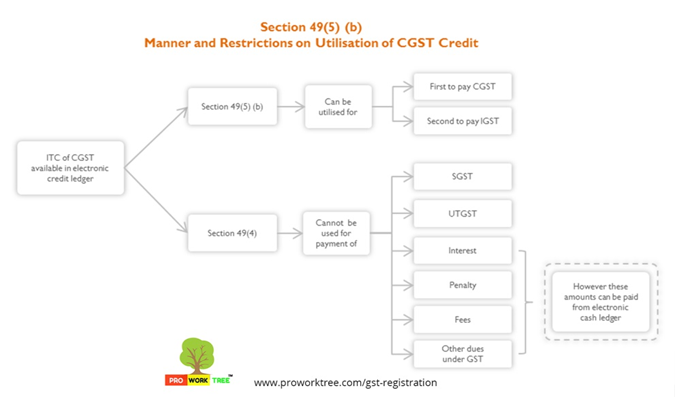

Section 49-5 -b Manner and Restrictions on utilisation of CGST Credit

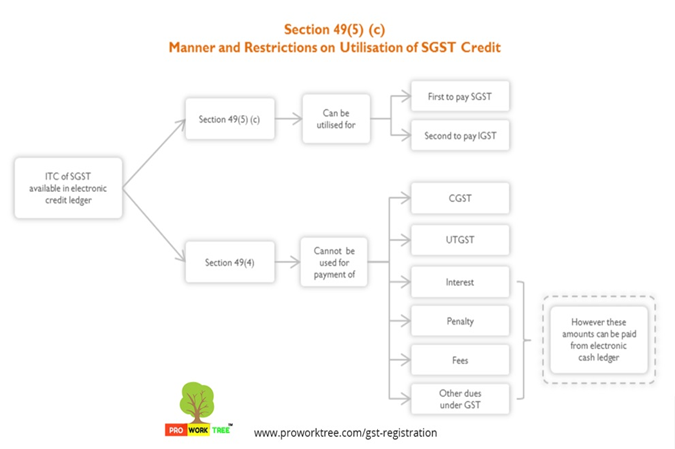

Section 49-5-c Manner and Restrictions on Utilisation of SGST Credit

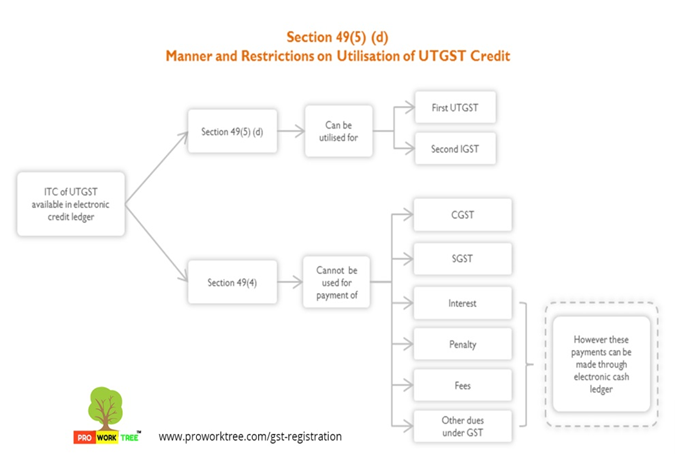

Section 49 - 5-d Manner and Restrictions on Utilisation of UTGST Credit

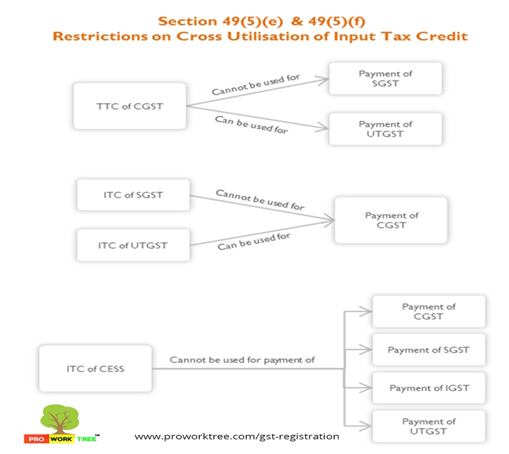

Section 49-5-e _ 49-5-f-Restrictions on Cross Utilisation of Input Tax Credit

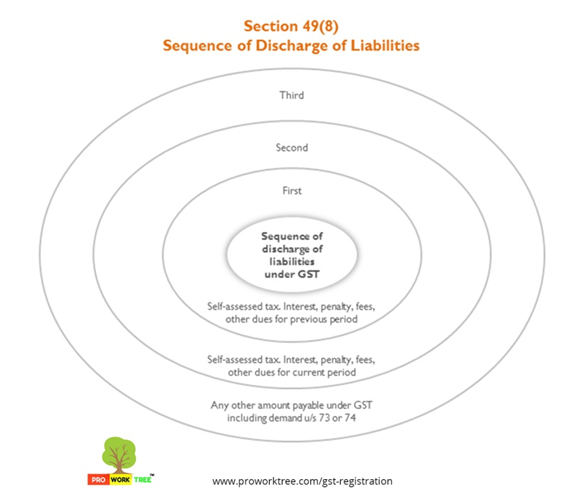

Section 49-8 Sequence of Discharge of Liabilities

Corporate Entity Registration

Corporate Entity Registration

0 comments have been posted.